Mortgage rates are the lifeblood of the housing market, their fluctuations dictating affordability and driving market dynamics. Understanding these rates—from historical trends to the impact of Federal Reserve policy—is crucial for both homebuyers and investors. This guide delves into the complexities of mortgage rates, examining their interplay with inflation, economic growth, and personal finance.

We’ll explore the differences between fixed-rate and adjustable-rate mortgages, analyze the influence of credit scores and loan terms, and provide insights into forecasting future rate movements. Ultimately, this deep dive aims to equip readers with the knowledge necessary to navigate the often-turbulent waters of the mortgage market.

Mortgage Rate and the Economy

Mortgage rates serve as a crucial barometer of economic health, reflecting broader financial conditions and influencing consumer behavior. Their fluctuations directly impact borrowing costs for homebuyers, subsequently affecting housing market activity and overall economic growth. Understanding the interplay between mortgage rates and the economy is vital for both policymakers and individuals.

Mortgage Rates and Economic Growth

A strong correlation exists between mortgage rates and economic growth. Low mortgage rates typically stimulate housing demand, leading to increased construction activity, job creation in related industries, and higher consumer spending fueled by increased home equity. Conversely, high mortgage rates dampen housing demand, slowing construction and potentially triggering a broader economic slowdown. For example, the sharp rise in mortgage rates in 2022, following the Federal Reserve’s aggressive interest rate hikes, contributed significantly to the cooling of the U.S.

housing market and broader economic deceleration. The subsequent drop in housing starts directly impacted employment in the construction sector and related industries.

Federal Reserve Monetary Policy and Mortgage Rates

The Federal Reserve’s monetary policy exerts significant influence on mortgage rates. The Fed’s target for the federal funds rate – the rate banks charge each other for overnight loans – directly impacts the overall cost of borrowing. When the Fed raises interest rates to combat inflation, as it did throughout 2022 and into 2023, borrowing becomes more expensive across the board, including mortgages.

This is because mortgage rates are typically tied to longer-term Treasury yields, which in turn are influenced by the Fed’s actions. Conversely, when the Fed lowers interest rates to stimulate economic growth, mortgage rates tend to fall, making borrowing more affordable and boosting housing demand. The 2008 financial crisis saw the Fed aggressively cut interest rates to near zero, resulting in historically low mortgage rates that temporarily fueled a housing market recovery.

Investor Confidence and Mortgage Rates

Investor confidence plays a significant role in shaping mortgage rates. When investors are optimistic about the economy, they are more likely to invest in mortgage-backed securities (MBS), increasing demand and pushing mortgage rates lower. Conversely, negative economic news or uncertainty can lead investors to pull back from MBS, reducing demand and driving mortgage rates higher. This is because MBS are a major component of the mortgage market, and changes in their value directly impact the cost of borrowing for consumers.

Geopolitical events, such as the war in Ukraine, or unexpected economic data releases can significantly influence investor sentiment and consequently, mortgage rates. A sudden drop in investor confidence can lead to a sharp increase in mortgage rates, regardless of the Fed’s monetary policy stance.

Mortgage Rate Affordability

The affordability of homeownership is inextricably linked to prevailing mortgage rates. Even small shifts in interest rates can significantly impact monthly payments and, consequently, the purchasing power of prospective homebuyers. This section explores the complex relationship between mortgage rates and affordability, illustrating the challenges faced by buyers in different income brackets.

Impact of Varying Mortgage Rates on Monthly Payments

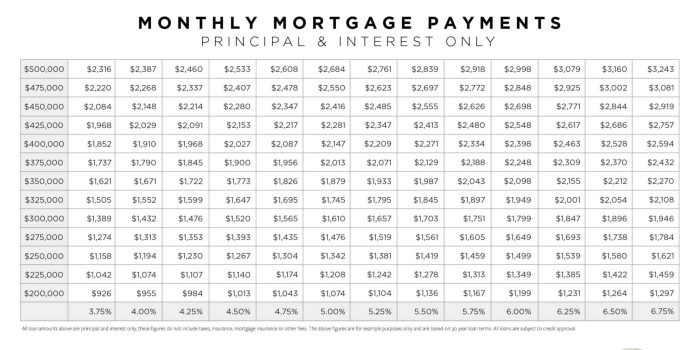

Consider a hypothetical scenario: a homebuyer seeks a $400,000 mortgage. With a 30-year fixed-rate mortgage at a 5% interest rate, the monthly principal and interest payment would be approximately $2,147. However, if interest rates rise to 7%, that same mortgage would result in a monthly payment of approximately $2,661 – a substantial increase of $514 per month. This difference underscores the significant impact even a relatively small percentage point increase in interest rates can have on a buyer’s budget.

This increase can be even more dramatic for larger mortgage amounts. A $600,000 mortgage would see an increase of approximately $771 per month under the same scenario.

Affordability of Homes Under Different Mortgage Rate Scenarios

The following table compares home affordability for different income levels under various mortgage rate scenarios. These figures are illustrative and assume a 20% down payment and standard lending criteria. Actual affordability may vary depending on individual circumstances and lender requirements.

| Income Level (Annual) | Mortgage Rate | Affordability Level (Maximum Loan Amount) | Maximum Home Price (20% Down Payment) |

|---|---|---|---|

| $80,000 | 5% | $250,000 | $312,500 |

| $80,000 | 7% | $200,000 | $250,000 |

| $120,000 | 5% | $375,000 | $468,750 |

| $120,000 | 7% | $300,000 | $375,000 |

Impact of Rising Mortgage Rates on Homebuyer Demand

Rising mortgage rates directly impact homebuyer demand. Higher monthly payments reduce the pool of potential buyers who can afford to purchase a home. This effect is particularly pronounced for first-time homebuyers and those with lower incomes. For example, the significant increase in mortgage rates observed in 2022 led to a sharp decline in home sales across many markets, as potential buyers were priced out of the market.

This reduced demand can lead to a slowdown in price appreciation or even price declines, creating a ripple effect throughout the housing market. The impact is often felt most acutely in areas with already high housing costs, where even a small increase in interest rates can significantly reduce affordability.

Mortgage Rate and Home Prices

The relationship between mortgage rates and home prices is complex and dynamic, often described as inversely correlated but with significant nuances depending on market conditions and other economic factors. Historically, lower mortgage rates have fueled increased demand, driving up home prices, while higher rates tend to cool the market, leading to price stagnation or even declines. However, this isn’t a simple cause-and-effect relationship; other factors, such as supply and demand, inflation, and economic growth, also play crucial roles.Changes in mortgage rates exert significant influence on home prices, both in the short and long term.

The immediate impact is felt through affordability. A sudden increase in rates shrinks the pool of potential buyers who can afford a given price, leading to a slowdown in sales and potentially price reductions. Conversely, a decrease in rates expands the pool of buyers, increasing competition and potentially pushing prices upward. The long-term effects are more nuanced, often depending on the persistence of the rate change and the broader economic environment.

Sustained low rates can lead to a prolonged period of price appreciation, while sustained high rates can result in a prolonged period of price stagnation or even decline, impacting the overall health of the housing market.

Short-Term Effects of Mortgage Rate Changes on Home Prices

A sharp increase in mortgage rates immediately reduces purchasing power for prospective homebuyers. This leads to a decrease in demand, forcing sellers to adjust prices to remain competitive. Conversely, a rapid decrease in rates stimulates demand, increasing competition among buyers and potentially driving prices higher, albeit temporarily until the market adjusts. The speed of adjustment varies depending on factors such as the existing inventory of homes and the overall economic climate.

For example, a sudden rate hike during a period of already low housing inventory might lead to a more pronounced and immediate price correction compared to a period of high inventory where the market can absorb some of the shock.

Long-Term Effects of Mortgage Rate Changes on Home Prices

The long-term relationship between mortgage rates and home prices is less straightforward than the short-term relationship. Prolonged periods of low mortgage rates can fuel a housing boom, leading to sustained price appreciation. However, this can also lead to unsustainable levels of home price inflation, creating a bubble that is vulnerable to bursting when rates eventually rise. Conversely, a prolonged period of high mortgage rates can dampen housing demand, resulting in a sustained period of price stagnation or even decline, but it also creates a more sustainable market in the long run.

The 2008 housing crisis serves as a stark example of the long-term consequences of unsustainable price appreciation fueled by low rates and loose lending standards.

Visual Representation of the Interplay Between Mortgage Rates and Home Prices

Imagine a graph with two lines: one representing average mortgage rates (y-axis) and the other representing average home prices (y-axis), both plotted against time (x-axis). The graph would show an inverse relationship, though not perfectly linear. When the mortgage rate line is low, the home price line tends to be high and vice-versa. However, the lines won’t mirror each other exactly.

There will be periods where the home price line lags behind the mortgage rate line, reflecting the time it takes for the market to react to changes in rates. There might also be periods where other economic factors override the influence of mortgage rates, causing temporary deviations from the inverse relationship. For example, a period of strong economic growth might push home prices higher even in the face of rising mortgage rates, reflecting the increased demand from a robust economy.

The graph would illustrate this complex interplay, showing the general inverse relationship but also highlighting the influence of other economic forces on the housing market.

Types of Mortgage Loans

Navigating the complexities of the mortgage market requires understanding the diverse loan options available to homebuyers. Choosing the right mortgage significantly impacts affordability and long-term financial health. This section Artikels the key differences between common mortgage types, helping consumers make informed decisions.

The mortgage landscape is diverse, offering various loan types tailored to different financial situations and borrower profiles. Understanding the nuances of each type is crucial for securing the best possible financing for a home purchase.

Types of Mortgage Loans Available to Consumers

Several types of mortgages cater to various needs and circumstances. Each offers unique eligibility criteria, costs, and benefits. Understanding these differences is key to selecting the most suitable option.

- Conventional Loans: These loans are not insured or guaranteed by a government agency. They typically require a larger down payment and higher credit scores.

- FHA Loans: Backed by the Federal Housing Administration, these loans are designed for borrowers with lower credit scores and smaller down payments. They often come with mortgage insurance premiums.

- VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to eligible veterans, active-duty military personnel, and surviving spouses. They typically require no down payment.

- USDA Loans: Offered by the U.S. Department of Agriculture, these loans are designed for rural homebuyers. They often have lower interest rates and may require no down payment.

- Jumbo Loans: These loans exceed the conforming loan limit set by Fannie Mae and Freddie Mac, requiring stricter underwriting guidelines and often higher interest rates.

Comparison of Mortgage Loan Types, Mortgage rate

A direct comparison highlights the key differences between these mortgage types, enabling borrowers to assess their suitability based on individual circumstances.

| Loan Type | Eligibility | Costs | Advantages |

|---|---|---|---|

| Conventional | Good credit score (typically 620 or higher), sufficient down payment (usually 20% or more), stable income | Higher interest rates (potentially), private mortgage insurance (PMI) if down payment is less than 20% | Lower interest rates compared to government-backed loans (potentially), no mortgage insurance premium if down payment is 20% or more |

| FHA | Lower credit score acceptable, lower down payment (as low as 3.5%), stable income | Mortgage insurance premium (MIP), higher closing costs (potentially) | Easier qualification for borrowers with lower credit scores, lower down payment requirements |

| VA | Eligible veteran, active-duty military personnel, or surviving spouse, Certificate of Eligibility | Funding fee (usually financed into the loan), potential closing costs | No down payment required (in most cases), competitive interest rates |

| USDA | Rural property location, income limits apply, credit score requirements vary | Guaranty fee, potential closing costs | Lower interest rates, potential for no down payment |

| Jumbo | Excellent credit score, high income, significant down payment (typically 20% or more) | Higher interest rates, stricter underwriting guidelines | Larger loan amounts available for high-value properties |

Mortgage Pre-Approval Process

Securing a mortgage pre-approval is a crucial first step in the home-buying journey. This process involves a lender assessing your financial situation to determine how much they’re willing to lend you for a mortgage. This pre-approval, essentially a conditional commitment, significantly strengthens your negotiating position when making an offer on a property.The pre-approval process streamlines the overall mortgage application, giving you a clear understanding of your borrowing power before you start house hunting, thus preventing wasted time viewing properties beyond your financial reach.

It also demonstrates to sellers that you’re a serious and qualified buyer, making your offer more attractive in a competitive market.

Steps Involved in Mortgage Pre-Approval

The pre-approval process typically unfolds in several key steps. First, you’ll select a lender and initiate the application. This involves providing the lender with essential financial information. Next, the lender will review your application and supporting documentation. If your application is deemed complete and meets their lending criteria, they’ll conduct a credit check and appraisal.

Finally, upon satisfactory completion of these steps, the lender will issue a pre-approval letter specifying the maximum loan amount they’re prepared to offer.

Necessary Documentation for Mortgage Pre-Approval

Obtaining pre-approval requires providing comprehensive financial documentation to the lender. This ensures the lender can accurately assess your creditworthiness and borrowing capacity. The following documents are typically required:

- Proof of Income: Pay stubs, W-2 forms, tax returns (typically the last two years), and self-employment documentation (if applicable).

- Bank Statements: Recent bank statements (typically the last two to three months) showing your assets and transaction history.

- Credit Report: A copy of your credit report, which the lender will often pull directly, showcasing your credit score and history.

- Government-Issued Identification: Driver’s license or passport.

- Employment Verification: A letter from your employer confirming your employment status, salary, and tenure.

- Debt Information: Details of any outstanding debts, such as credit card balances, student loans, or car loans.

Importance of Pre-Approval Before House Hunting

Obtaining mortgage pre-approval before actively searching for a home offers several significant advantages. Knowing your budget beforehand prevents you from falling in love with a house that is ultimately unaffordable. It allows you to focus your search on properties within your price range, saving time and avoiding emotional disappointment. Furthermore, a pre-approval letter strengthens your offer significantly, making you a more competitive buyer in a potentially crowded market.

Sellers are more likely to accept an offer from a pre-approved buyer because it demonstrates financial readiness and reduces the risk of the deal falling through due to financing issues. For example, in a highly competitive market like the one experienced in many major US cities in 2021, pre-approval significantly increased the likelihood of a successful offer.

Impact of Mortgage Rates on the Housing Market

Mortgage rates are a pivotal force shaping the dynamism of the housing market. Their fluctuations directly influence borrowing costs, affordability, and consequently, the overall level of market activity. Understanding the relationship between mortgage rates and housing market performance is crucial for both prospective homebuyers and market analysts.Low mortgage rates stimulate housing market activity by making homeownership more accessible and attractive.

This translates to increased demand, potentially driving up home prices and accelerating the pace of sales. Conversely, high mortgage rates dampen demand, leading to slower sales and potentially price corrections. The volatility of these rates introduces an additional layer of complexity, creating uncertainty and impacting both buyer and seller behavior.

Low Mortgage Rates and Housing Market Activity

Periods of low mortgage rates typically result in a surge in housing market activity. The reduced cost of borrowing incentivizes more individuals and families to enter the market, increasing demand for homes. This increased demand, coupled with a potentially constrained supply, can lead to significant price appreciation. The 2020-2021 period, characterized by historically low interest rates and government stimulus programs, serves as a prime example.

This environment fueled a dramatic increase in home sales and price growth across many regions of the U.S., leading to a highly competitive market. The influx of buyers, often competing for a limited inventory of homes, further pushed prices upward.

High Mortgage Rates and Housing Market Activity

Conversely, a period of elevated mortgage rates has a cooling effect on the housing market. The increased cost of borrowing makes mortgages less affordable, reducing the pool of potential buyers. This decreased demand can lead to a slowdown in sales, potentially causing a decline in home prices. The sharp increase in mortgage rates in late 2022 and early 2023, following the Federal Reserve’s interest rate hikes, offers a recent illustration.

This led to a noticeable decrease in purchase applications and a deceleration in price growth, impacting various housing markets across the country. The affordability challenge became a significant barrier for many potential homebuyers, reducing market competition.

Impact of Mortgage Rate Volatility on the Housing Market

Fluctuations in mortgage rates introduce uncertainty into the housing market, impacting both buyer and seller behavior. Rapid and unpredictable shifts in rates can lead to hesitancy among buyers, causing them to delay purchasing decisions or renegotiate offers. Sellers, too, may become hesitant, uncertain about the optimal time to list their property. This volatility can create a period of market instability, characterized by fluctuating prices and transaction volumes.

The unpredictable nature of rate changes can make it difficult for both buyers and sellers to make informed decisions, potentially leading to missed opportunities or unfavorable transactions. For example, a sudden spike in rates might cause a buyer to withdraw an offer, while a seller might miss a window of opportunity due to anticipating further rate increases.

Mortgage Rate Forecasting

Predicting future mortgage rates is a complex undertaking, crucial for both borrowers and lenders navigating the housing market. Accuracy is challenging due to the interplay of numerous economic and market forces, making forecasting an inexact science reliant on a combination of quantitative models and qualitative judgment.Forecasting mortgage rates involves a multifaceted approach, combining econometric modeling with an assessment of qualitative factors.

Quantitative methods often incorporate statistical analysis of historical rate data, incorporating leading indicators like inflation, unemployment, and economic growth. These models attempt to identify correlations and patterns to extrapolate future rate movements. Qualitative analysis, however, is equally important, considering factors that are difficult to quantify, such as shifts in investor sentiment, geopolitical events, and central bank policy pronouncements.

Methods Used in Mortgage Rate Forecasting

Several techniques are employed to forecast mortgage rates. These include time-series analysis, which examines historical rate patterns to predict future trends; regression analysis, which identifies relationships between mortgage rates and other economic variables; and leading indicator analysis, which utilizes variables that tend to precede changes in mortgage rates, such as changes in the Federal Funds rate. Sophisticated models may also incorporate machine learning algorithms to identify complex relationships within large datasets.

For example, a model might analyze historical data on inflation, unemployment, and the 10-year Treasury yield to predict changes in the 30-year fixed mortgage rate. The accuracy of these forecasts varies considerably depending on the model’s complexity and the accuracy of the underlying data.

Factors Considered in Mortgage Rate Predictions

Experts consider a wide range of factors when forecasting mortgage rates. Key among these are:

- Federal Reserve Policy: The Federal Reserve’s monetary policy decisions, particularly changes to the federal funds rate, significantly impact mortgage rates. A rate hike typically leads to higher mortgage rates, while a rate cut generally results in lower rates. For example, the aggressive rate hikes implemented by the Fed in 2022 to combat inflation directly translated into a sharp increase in mortgage rates.

- Inflation: High inflation generally leads to higher mortgage rates as lenders adjust their rates to compensate for the decreased purchasing power of money. Conversely, low inflation may contribute to lower rates.

- Economic Growth: Strong economic growth can put upward pressure on mortgage rates due to increased demand for loans and higher inflation. Recessions, on the other hand, often lead to lower rates as lenders seek to stimulate borrowing.

- Investor Sentiment and Market Conditions: Investor confidence and broader market conditions significantly influence mortgage rates. Periods of uncertainty or risk aversion can lead to higher rates as lenders demand greater returns.

- Supply and Demand for Mortgages: The balance between the supply of available mortgages and the demand from borrowers also affects rates. High demand can drive rates upward.

Limitations of Mortgage Rate Forecasts

While forecasting models provide valuable insights, it’s crucial to acknowledge their inherent limitations. The accuracy of any forecast is limited by the unpredictable nature of economic events and market sentiment. Unexpected geopolitical events, regulatory changes, or shifts in investor behavior can significantly impact rates, making even the most sophisticated models susceptible to error. Furthermore, models often rely on historical data, which may not accurately reflect future conditions, particularly during periods of significant economic or market transformation.

For instance, the COVID-19 pandemic and the subsequent economic disruption highlighted the limitations of relying solely on historical patterns to predict mortgage rate movements. Finally, forecasts are inherently probabilistic, providing a range of possible outcomes rather than a single definitive prediction.

Mortgage rates, already sensitive to economic indicators, are showing further volatility. Unexpected shifts in regional weather patterns, as seen recently in the Weather reports, can impact agricultural yields and energy prices, thus influencing inflation and ultimately impacting the Federal Reserve’s decisions on interest rates. This ripple effect underscores the interconnectedness of seemingly disparate factors in shaping mortgage costs.

Mortgage Rate and Personal Finance

Integrating mortgage rates effectively into your personal financial planning is crucial for long-term financial health. Understanding how interest rate fluctuations impact your borrowing costs and overall financial stability allows for proactive adjustments and informed decision-making. Failing to account for these variables can lead to significant financial strain.Mortgage rates are a significant factor influencing the affordability and overall cost of homeownership.

They directly affect monthly payments, the total amount paid over the life of the loan, and your ability to allocate funds towards other financial goals such as retirement savings or investments. Therefore, careful consideration of current and projected rates is paramount.

Mortgage Payment Management During Rising Rates

Rising interest rates present a challenge to homeowners, particularly those with adjustable-rate mortgages (ARMs). Strategies for managing these increased payments include budgeting adjustments, exploring refinancing options, and potentially increasing income. A thorough review of personal finances and proactive planning are essential to navigate this period effectively. For example, a homeowner with an ARM might proactively reduce discretionary spending or seek additional income streams to offset the increased mortgage payment.

Refinancing to a fixed-rate mortgage might be an option, though it depends on current market conditions and the homeowner’s creditworthiness.

Long-Term Financial Implications of Mortgage Terms and Rates

The choice of mortgage term (e.g., 15-year vs. 30-year) and interest rate significantly impacts long-term financial outcomes. A shorter-term mortgage with a higher initial payment results in less interest paid over the life of the loan, leading to substantial savings. Conversely, a longer-term mortgage with lower monthly payments allows for greater flexibility in the short term but leads to higher overall interest payments.

For instance, a 15-year mortgage at a 6% interest rate will result in significantly lower total interest paid compared to a 30-year mortgage at the same rate, although the monthly payments will be higher. This necessitates a careful balancing of short-term affordability with long-term financial goals. Choosing a fixed-rate mortgage provides predictable monthly payments, shielding borrowers from fluctuating interest rates, while an adjustable-rate mortgage offers lower initial payments but exposes borrowers to interest rate risk.

Navigating the mortgage market requires a nuanced understanding of its intricate dynamics. From the historical interplay between rates and inflation to the impact of Federal Reserve policy and investor sentiment, a comprehensive grasp of these factors is paramount. By understanding the various loan types, the pre-approval process, and the long-term financial implications of rate choices, prospective homebuyers can make informed decisions and secure their financial futures.

Questions Often Asked

What is a good mortgage rate?

A “good” mortgage rate is relative and depends on prevailing market conditions and your individual financial situation. Generally, a rate below the average for your loan type and term is considered favorable.

How often do mortgage rates change?

Mortgage rates can fluctuate daily, reflecting changes in the broader economic landscape. Factors such as inflation, economic growth, and Federal Reserve policy significantly influence these changes.

Can I refinance my mortgage if rates drop?

Yes, refinancing can be a viable option if rates drop significantly, allowing you to potentially lower your monthly payments or shorten your loan term. However, closing costs must be considered.

What is an escrow account?

An escrow account is a dedicated account held by your lender to collect and pay your property taxes and homeowners insurance. These payments are typically included in your monthly mortgage payment.